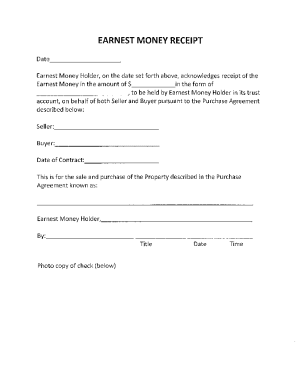

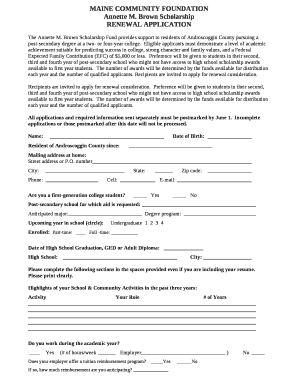

Earnest Money Receipt free printable template

Show details

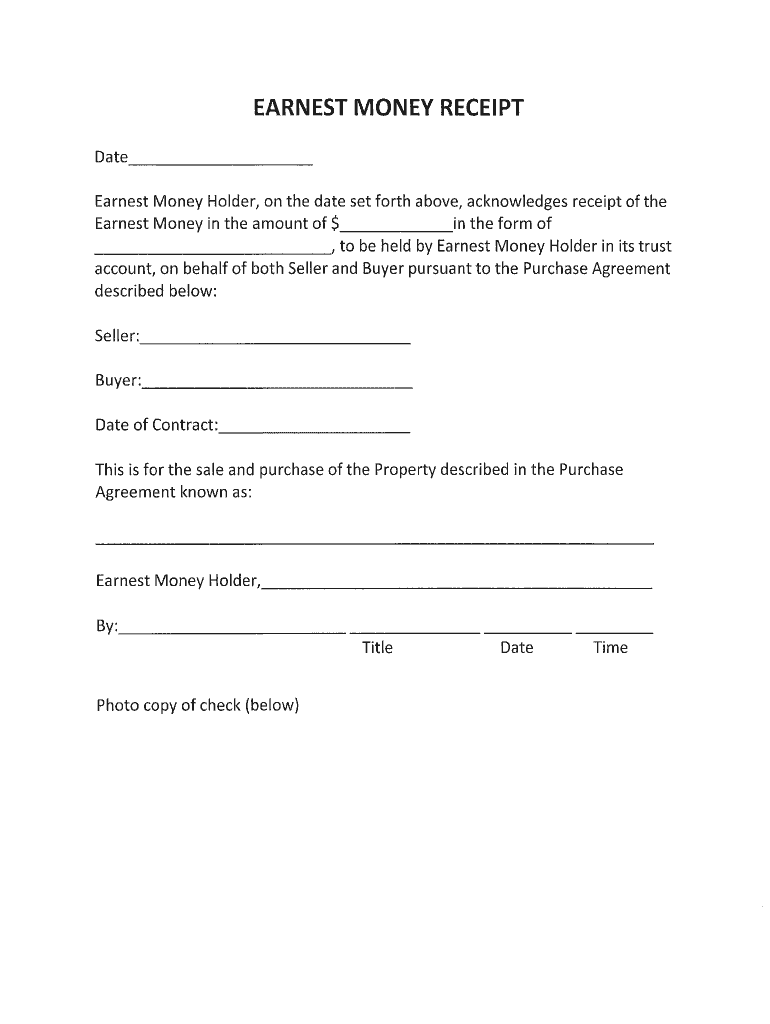

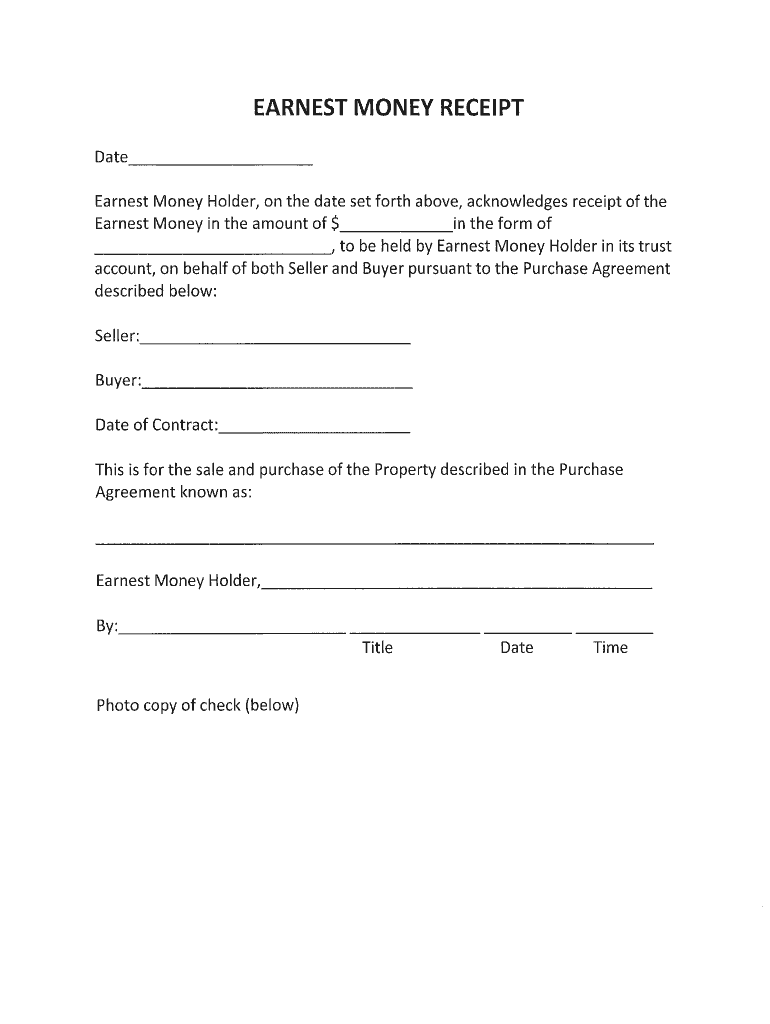

Earnest Money Holder, on the date set forth above, acknowledges receipt of the. Earnest Money in the amount OFS in the form of. , to be held by Earnest Money ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign earnest receipt form

Edit your proof of earnest money deposit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your earnest money deposit receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing earnest money receipt online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit receipt form for earnest money. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out escrow deposit form

How to fill out Earnest Money Receipt

01

Start by filling out the date on the receipt.

02

Include the names of all parties involved in the transaction (buyer and seller).

03

Specify the property address clearly.

04

Indicate the amount of earnest money being submitted.

05

State the purpose of the earnest money within the context of the sale.

06

Include the method of payment (e.g., check, cash).

07

Provide spaces for both parties to sign and date the receipt.

Who needs Earnest Money Receipt?

01

Buyers wishing to make a serious offer on a property.

02

Sellers who require assurance that the buyer is committed to the purchase.

03

Real estate agents to facilitate and document the transaction.

04

Legal entities or professionals involved in the real estate transaction.

Fill

earnest money receipt template

: Try Risk Free

People Also Ask about earnest money agreement form

What is the earnest money agreement?

Earnest money is essentially a deposit a buyer makes on a home they want to purchase. A contract is written up during the exchange of the earnest money that outlines the conditions for refunding the amount. Earnest money deposits can be anywhere from 1–10% of the sales price, depending mostly on market interest.

What form must earnest money be?

The owner must be aware that the earnest money deposit will be made in the form of a promissory note (i.e., not in cash) before it accepts the purchase offer. This fact must also be stated clearly in the purchase agreement itself.

What is the release of earnest money form?

A release of earnest money form is a waiver signed by both the buyer and seller before an earnest money deposit towards a property may be released.

How do I write an earnest money agreement?

[Buyer. FirstName][Buyer. LastName] at this moment agrees to pay a sum of $(Total Purchase Price of the Property) for the property as outlined above or a cash equivalent. The buyer agrees to settle or discharge all previous debts and obligations of any nature within the county in which the said property is located.

What is the release of earnest money form in Texas realtors?

What the TAR form does. The Texas REALTORS® Release of Earnest Money form allows the parties to agree to release the earnest money and to release each other, any broker, title company, or escrow agent from liability under the contract.

What is the earnest money form?

An earnest money agreement is a legal document that outlines the terms between two parties, typically for the purchase and sale of real estate. When buying a property, a buyer will provide an earnest money deposit to signal their intentions are high to move forward with the transaction.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit earnest money contract in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing deposit receipt real estate and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an eSignature for the how to fill out earnest 04 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your earnest money agreement right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit earnest money deposit receipt form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit an earnest money receipt is and forms in the cloud.

What is Earnest Money Receipt?

An Earnest Money Receipt is a document that acknowledges the receipt of a deposit made by a buyer to demonstrate their commitment to purchasing a property.

Who is required to file Earnest Money Receipt?

Typically, the buyer or their real estate agent is required to file the Earnest Money Receipt as part of the purchase agreement process.

How to fill out Earnest Money Receipt?

To fill out an Earnest Money Receipt, include the buyer's and seller's names, the amount of earnest money, the property address, and the date received, along with signatures from both parties or their agents.

What is the purpose of Earnest Money Receipt?

The purpose of an Earnest Money Receipt is to serve as a formal record of the deposit made by the buyer, showing their intent to purchase and protecting the interests of both parties.

What information must be reported on Earnest Money Receipt?

The Earnest Money Receipt must report the names of the buyer and seller, the amount of earnest money, the property details, the date of the transaction, and signatures from all involved parties.

Fill out your Earnest Money Receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Real Estate Down Payment Receipt is not the form you're looking for?Search for another form here.

Keywords relevant to printable earnest money agreement

Related to an earnest money receipt form is a the deposit purpose of the payment

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.